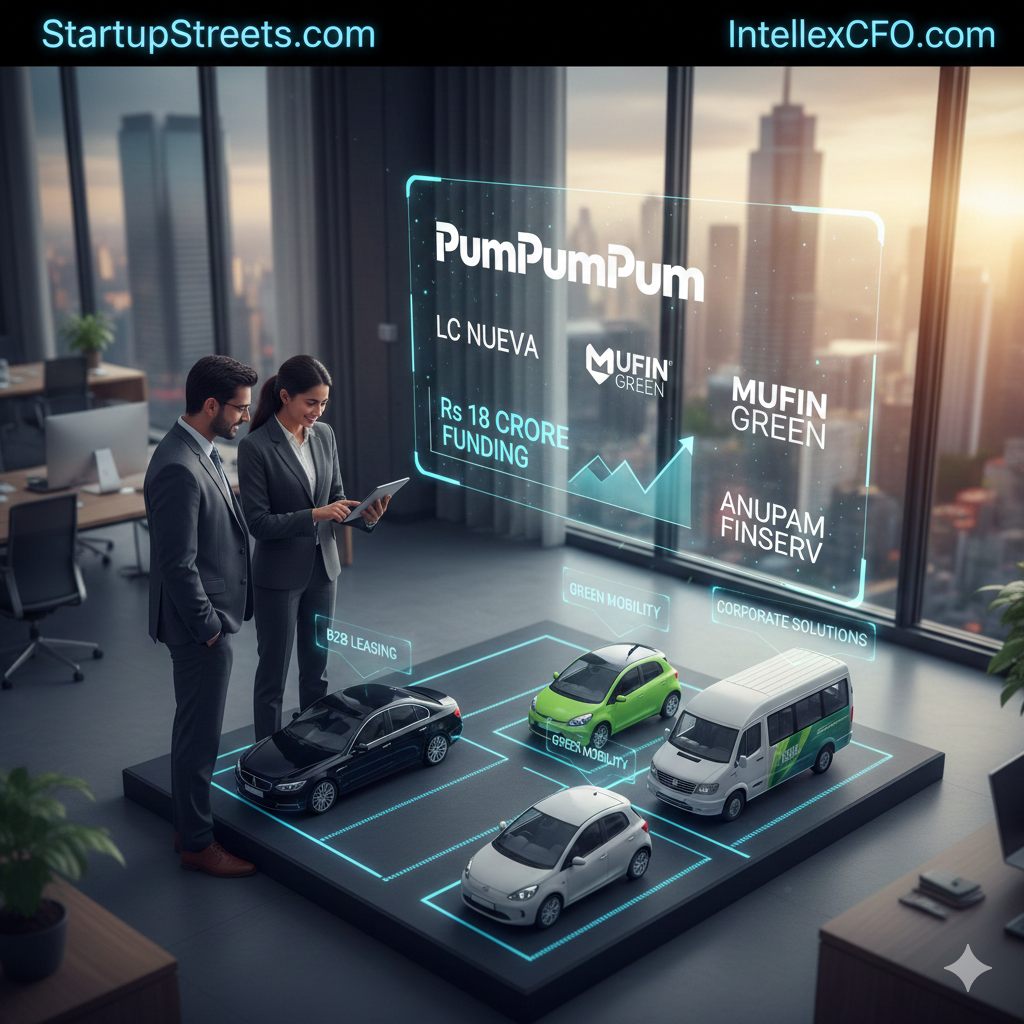

PumPumPum Shifts Gears with Rs 18 Crore Pre-Series A Funding to Revolutionize Corporate Mobility.

Gurugram-based PumPumPum raises Rs 18 crore in pre-Series A funding led by LC Nueva. Learn how the startup is pivoting from used car leasing to full-stack corporate mobility.

Also Read: Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

In a significant move that underscores the growing demand for flexible vehicle ownership, PumPumPum, a pioneer in the used car leasing space, has successfully secured Rs 18 crore in its pre-Series A funding round.

The investment was led by LC Nueva Investment Partners, with strong participation from Mufin Green Finance and Anupam Finserv. This capital infusion marks a pivotal moment for the Gurugram-based startup as it transitions from a niche leasing platform into a full-stack B2B and B2B2C corporate mobility solutions provider.

Strategic Growth and Market Expansion

This latest round comes on the heels of a Rs 2 crore funding boost led by Inflection Point Ventures (IPV) in March 2024. With a total of Rs 20 crore raised within the last year, PumPumPum is well-positioned to scale its operations and enhance its technology stack.

The company plans to utilize the fresh funds to:

- Expand its Fleet: Increasing the volume of available vehicles to meet rising corporate demand.

- Tech Integration: Developing seamless B2B platforms for corporate fleet management.

- Market Penetration: Strengthening its presence in Tier 1 and Tier 2 cities across India.

From Used Car Leasing to Full-Stack Mobility

While PumPumPum initially made headlines by offering monthly subscriptions for pre-owned cars, its new trajectory focuses on the corporate ecosystem. By offering B2B (Business-to-Business) and B2B2C (Business-to-Business-to-Consumer) models, the company is solving a major pain point for organizations: the high cost and administrative burden of maintaining company-owned fleets.

”Our goal is to redefine how corporate India moves. By transitioning to a full-stack mobility provider, we are offering companies a smarter, asset-light way to manage employee transportation and logistics,” the company stated regarding its strategic shift.

The Investor Perspective

The participation of LC Nueva and Mufin Green highlights a growing investor confidence in sustainable and flexible mobility. As the Indian automotive market shifts toward “usership” over “ownership,” PumPumPum’s model provides a bridge for those seeking the convenience of a vehicle without the long-term financial commitment of a loan.

Key Highlights of the Funding Round

Feature | Details |

|---|---|

Amount Raised | Rs 18 Crore |

Round | Pre-Series A |

Lead Investor | LC Nueva Investment Partners |

Co-Investors | Mufin Green Finance, Anupam Finserv |

Previous Funding | Rs 2 Crore (March 2024) |

Core Focus | B2B & B2B2C Corporate Mobility |

With this fresh capital, PumPumPum is set to challenge traditional car rental and leasing giants by leveraging data-driven maintenance and a customer-centric approach to corporate travel.

Team: IntellexCFO.com

More Featured Articles:

Ultimate Guide to Singapore Company Registration 2026: Rules, Costs, and Compliance

Speciale Invest Launches ₹1,400 Crore Growth Fund II to Accelerate India’s Deeptech Scale-Up Story

A16z’s $15 Billion Power Move: Inside the Mega-Fund Shaking Up Global Venture Capital