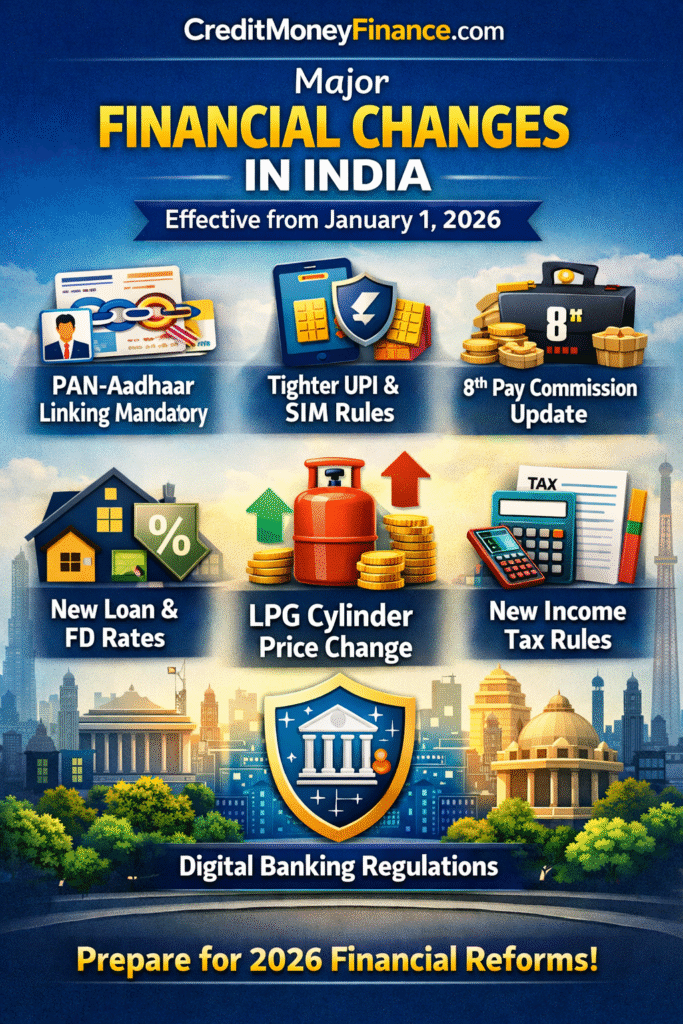

Major Financial Rule Changes in India from January 1, 2026: PAN-Aadhaar, UPI, Tax, Salary & Banking Updates Explained.

India’s financial rules are changing from January 1, 2026. Learn about PAN-Aadhaar linking, UPI security, new income tax rules, 8th Pay Commission, LPG prices, and banking updates.

🚨 Financial Rule Changes in India from January 1, 2026: What You Must Know.

The Government of India is set to introduce several important financial and regulatory changes from January 1, 2026. These updates will impact banking, taxation, digital payments, government salaries, household expenses, and digital security. Understanding these changes in advance can help individuals, taxpayers, investors, and businesses prepare better.

Also Read: SIDBI – Powering India’s MSME Growth: Funding, Schemes & Business Support

Here’s a detailed breakdown of the key financial rule changes in India for 2026:

1. PAN–Aadhaar Linking Becomes Mandatory :

Linking your PAN with Aadhaar will be compulsory before December 31, 2025.

Key implications:

Unlinked PAN cards may become inactive or deactivated

Difficulty in filing Income Tax Returns (ITR)

Delays or denial of tax refunds

Restricted access to banking and financial services

This move aims to improve tax compliance, reduce fraud, and enhance transparency in the Indian financial system.

2. Stricter Rules for UPI, SIM Verification & Messaging Apps.:

To curb rising digital fraud and cybercrime, stricter regulations will apply to:

UPI transactions

SIM card verification

Messaging apps such as WhatsApp, Telegram, and Signal

Expected changes include:

Enhanced KYC verification for UPI users

Tighter SIM re-verification norms

Stronger identity checks for messaging platforms linked to financial activities

These measures aim to strengthen digital payment security and protect users from online scams.

3. Revised Loan & Fixed Deposit (FD) Interest Rates .

Leading banks like SBI, PNB, and HDFC Bank have announced revised interest rates effective around 2026.

Impact:

Possible benefits for home loan, personal loan, and auto loan borrowers

Updated fixed deposit (FD) interest rates offering revised returns for investors

Improved opportunities for financial planning and wealth management

Customers are advised to review their loan agreements and investment portfolios.

4. Implementation of the 8th Central Pay Commission.

The 8th Pay Commission is expected to be implemented from January 1, 2026, bringing:

Revised salaries for central government employees

Higher pension benefits for retired staff

While this will increase disposable income, it may also lead to:

Higher fuel, transportation, and vehicle costs

Increased inflationary pressure on daily expenses

Also Read: Kotak Mahindra Bank – SME & Wholesale Lending Solutions (₹7–200 Cr)

5. LPG Cylinder Price Revision:

LPG cylinder prices will be reviewed on January 1, 2026.

Possible outcomes:

Price hike or reduction depending on global energy prices

Direct impact on household budgets and monthly expenses

Consumers should stay alert to government announcements on domestic LPG subsidies and pricing.

6. New Income Tax Act & ITR Changes:

The government is preparing for the rollout of updates under the New Income Tax Act.

Expected updates include:

Notification of new ITR forms

Simplified tax assessment rules

Enhanced digital tax filing systems

These reforms aim to make income tax filing easier, faster, and more transparent for taxpayers.

7. Mandatory Digital Banking Authorisation 🛡️.

From January 1, 2026, banks must obtain explicit regulatory authorisation to offer:

Internet banking

Mobile banking apps

USSD, SMS, and other electronic banking services

This step will strengthen customer data protection, cybersecurity, and digital banking governance.

Conclusion:

The financial rule changes in India from 2026 reflect the government’s focus on digital security, tax transparency, banking reforms, and economic stability. Staying informed and prepared will help individuals and businesses adapt smoothly to the evolving financial landscape.

Team: CreditMoneyFinance.com

More Featured Articles:

Building Future Leaders: The Birla Open Minds School Franchise Opportunity

Why Every Startup and Growing Business Needs a Virtual CFO And Why IntellexCFO Is Your Best Partner