Loans and Finance for Schools, Colleges & Educational Institutions – Funding Solutions India

Loans & Finance for Educational Institutions: Complete Guide for Schools, Colleges, Universities & EdTech Institutions.

Avail loans for schools, colleges, universities, medical colleges, engineering institutes & educational trusts. Expansion, working capital, infrastructure funding.

Contact IntellexConsulting.com – 98200-88394.

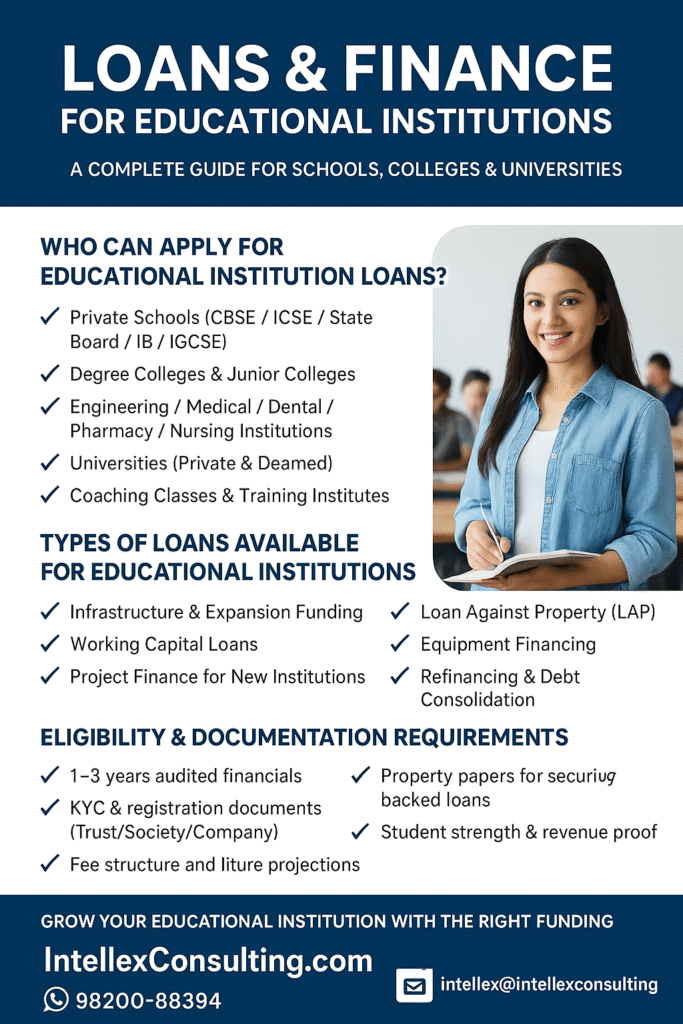

Loans & Finance for Educational Institutions – A Complete Guide for Schools, Colleges & Universities

The education sector in India is expanding rapidly.

Private schools, colleges, medical & engineering institutes, coaching centres, training academies, universities and EdTech companies are continuously investing in infrastructure, expansion, technology, new campuses, digital facilities and working capital.

Also Read: Kotak Mahindra Bank – SME & Wholesale Lending Solutions (₹7–200 Cr)

To support this growth, institutional loans for educational entities have become one of the most sought-after financial products. Whether you are starting a new campus or upgrading an existing one, structured finance solutions can unlock growth opportunities.

IntellexConsulting.com specializes in arranging such funding across India.

📞 WhatsApp: 98200-88394

📩 Email: intellex@intellexconsulting.com

Who Can Apply for Educational Institution Loans?

✔ Private Schools (CBSE / ICSE / State Board / IB / IGCSE)

✔ Degree Colleges & Junior Colleges

✔ Engineering / Medical / Dental / Pharmacy / Nursing Institutions

✔ Universities (Private & Deemed)

✔ Coaching Classes & Training Institutes

✔ Trust / Society / Section 8 Companies operating education entities

✔ Vocational Training Centres, EdTech & E-learning institutions

Types of Loans Available for Educational Institutions.

1. Infrastructure & Expansion Funding

For new buildings, classrooms, laboratories, hostels, land purchase, campuses, libraries etc.

💠 Tenure: 5–15 years

💠 High loan amount based on asset value

💠 Ideal for large growth projects

2. Working Capital Loans

For daily operational expenses, salaries, vendor payments, administrative cost etc.

💠 Loan tenure: up to 5 years

💠 OD/Cash Credit/Term funding options available

3. Project Finance for New Institutions

Best for greenfield educational projects.

💠 Funding based on project feasibility

💠 Flexible repayment linked to revenue generation

4. Loan Against Property (LAP)

Educational property or land can be mortgaged to raise funds.

💠 Quick processing

💠 Competitive interest rates

5. Equipment Financing

For labs, computers, smart classes, furniture, buses, interiors & infra.

6. Refinancing & Debt Consolidation

To reduce interest burden & improve cash flow.

Eligibility & Documentation Requirements

📌 1–3 years audited financials

📌 KYC & registration documents (Trust/Society/Company)

📌 Property papers for security-backed loans

📌 Student strength & revenue proof

📌 Fee structure and future projections

Availability varies case-to-case, and IntellexConsulting.com assists with complete documentation support.

Also Read: SIDBI – Powering India’s MSME Growth: Funding, Schemes & Business Support

Why Educational Institutions Seek Funding.

Construction/expansion of school buildings & new floors

Setting up digital classrooms, labs & technology upgrades

Purchase of land or new campus establishment

Working capital to manage seasonal cash flow

Bank overdraft requirements

Transportation buses & equipment purchase

Hostel/Library/Playground development

Franchise expansion for chains of institutions

Benefits of Availing Professional Loan Arrangement Services.

✔ Faster loan approvals through structured processing

✔ Expert negotiation for best interest rates

✔ Guidance for documentation & financial planning

✔ Access to Banks + NBFCs + Private/Institutional Funding

✔ Customized solutions for large educational projects

Loan Amounts & Interest Range.

₹50 Lakhs to ₹500+ Crores depending on size

Interest starting from 8.50% p.a. onwards (variable as per profile)

Higher ticket project funding for large universities / medical colleges.

Why Choose IntellexConsulting.com for Educational Institution Finance?.

Intellex Consulting is a trusted professional loan arranger for institutional funding across India with strong relationships in Banks, NBFCs, Financial Institutions & Private Investors.

🔹 Specialised in educational sector financing

🔹 PAN India processing – urban & rural projects

🔹 End-to-end support from assessment to disbursement

🔹 Strong experience with large cap projects & trusts

Grow Your Educational Institution with the Right Funding Partner

If you are running a school, college, medical institution or a university and planning expansion, infrastructure development or seeking working capital, the right funding can accelerate your growth exponentially..

Contact us for feasibility discussions or immediate loan support..

📞 WhatsApp: 98200-88394

🌐 Website: IntellexConsulting.com

📩 Email: intellex@intellexconsulting.com

Team: Creditmoneyfinance.com

More Featured Articles:

Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

Funding and Investment Options to Grow India’s Real Estate & Allied Businesses

Infrastructure Finance in India: Concept, Evolution, Key Players, and the Road Ahead.

Building Future Leaders: The Birla Open Minds School Franchise Opportunity

Expert Guidance on Compliance for Private Limited Companies and LLP in India