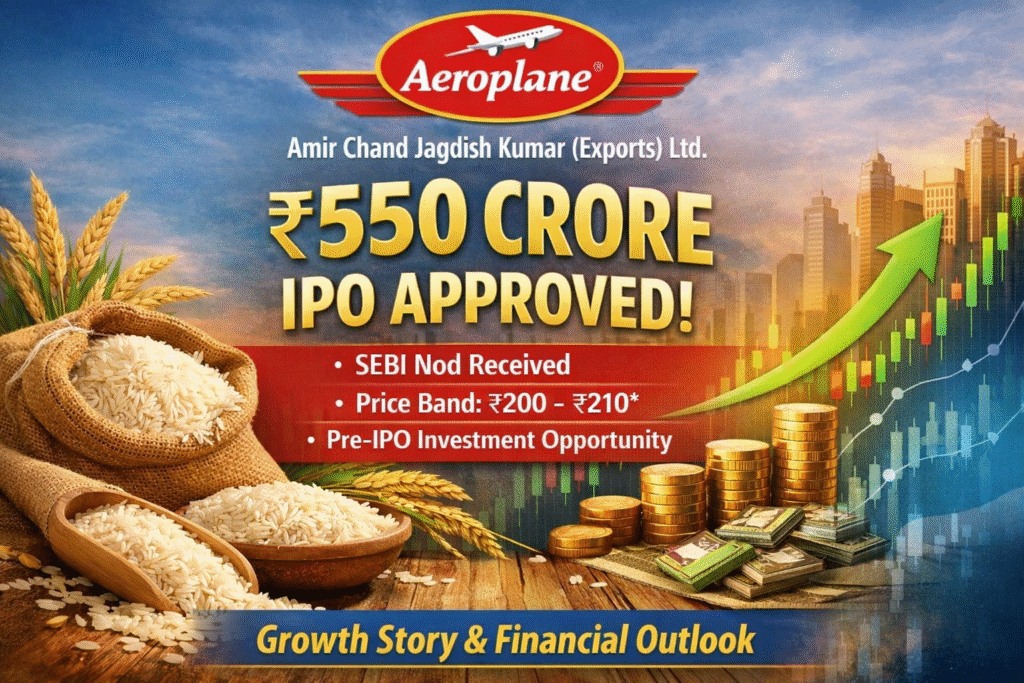

Aeroplane Basmati Rice Maker ACJKEL Gets SEBI Nod for ₹550 Crore IPO: Business History, Growth Trajectory, Financials, and Outlook.

Amir Chand Jagdish Kumar (Exports) Ltd (ACJKEL), owner of the Aeroplane rice brand, has received SEBI approval for a ₹550 crore IPO.

Here’s a detailed look at its origin story, integrated basmati value-chain model, export footprint, recent financial performance, and growth outlook..

Aeroplane Basmati Rice Maker ACJKEL Gets SEBI Nod for ₹550 Crore IPO:

Business History, Growth Trajectory, Financials, and Outlook.

India’s branded basmati rice space has a few well-known names, but every once in a while, a “quiet scaler” shows up strong revenue, deep distribution, and a brand that’s been sitting on the shelf for years without aggressive marketing spends.

That’s the story investors are now tracking in Amir Chand Jagdish Kumar (Exports) Limited (ACJKEL), the company behind the “Aeroplane” basmati rice brand, after it received SEBI approval for its proposed public issue.

We break down ACJKEL’s history, business model, growth trajectory, key financial trends, and forward outlook, using information available in its draft offer documents and other public sources.

Also Read: Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

Snapshot: What’s happening with the IPO?

DRHP filed with SEBI: June 2025

SEBI approval received:

IPO size: ₹550 crore (entirely fresh issue; no OFS indicated in the draft documents)

Important note on price band.

Many public IPO trackers still show the price band as “to be announced” because the DRHP typically does not contain the final price band rather it is declared closer to the issue opening via public advertisements and the RHP.

Company background: a legacy rice business that scaled into a branded exporter.

ACJKEL’s story is best understood in two phases:

1) Legacy roots in rice trading / processing

Public credit / rating documents and industry references describe the promoter family’s rice operations as dating back decades (often referenced to the mid-1980s), before the corporate structure existed in its current form.

2) Corporate incorporation and consolidation from 2003 onwards.

The company was incorporated as a public limited entity in 2003, and subsequently consolidated assets / business lines through acquisitions / transfer of the earlier proprietorship operations.

Over time, ACJKEL developed Aeroplane into a flagship brand, and expanded into a multi-brand portfolio across price tiers and geographies.

What ACJKEL sells: Aeroplane + a house of sub-brands.

While basmati rice remains the core revenue driver, ACJKEL has built a wide product architecture:

Flagship brand: Aeroplane

Multiple sub-brands spanning premium / mid / value categories.

Portfolio breadth designed to address different consumer segments and export preferences.

In recent years, the company has also moved into FMCG staples (often positioned as “kitchen essentials”), such as:

Atta, maida, sooji, besan, sugar, salt, and select rice-flour based products.

This matters strategically because staples can:

improve distributor throughput,

increase shelf presence,

reduce dependence on a single category cycle,

and deepen household-level repeat purchase behavior.

Integrated operating model:

Why the value chain matters in basmati

Basmati is not just a commodity, it’s a procurement + storage + ageing + processing game. ACJKEL operates as an integrated player across the chain:

Procurement muscle:

Strong sourcing relationships via a large agent network in North India’s basmati-growing regions

Storage and ageing:

Storage capacity matters because ageing impacts premium basmati realization and consistency (key for exports).

Processing, grading, packaging:

Multiple facilities support scale and allow packaging formats suited for both domestic retail and export channels.

Distribution and exports.

ACJKEL has a meaningful exports component, selling across 37+ countries with a strong Middle East presence.

Scale and infrastructure: capacity headroom is a growth lever

ACJKEL operates multiple manufacturing / processing and packaging facilities in North India, with sizable installed capacity.

A key investor angle here is utilization:.

If demand and distribution expand faster than capacity additions, operating leverage can improve margins.

If capacity stays underutilized, returns depend more heavily on pricing / brand lift and working-capital efficiency.

In other words, the company’s installed base provides headroom, but execution on distribution and brand-building decides how quickly that headroom becomes profitable throughput.

Growth trajectory: revenue scaled despite modest advertising.

One of the more discussed aspects of ACJKEL’s positioning is that it has achieved meaningful revenue scale with relatively lower brand spends versus some listed peers.

That can cut both ways:

Positive: suggests strong distribution pull and export relationships.

Risk/Opportunity: indicates the brand still has room to be “built up,” which requires investment discipline to avoid margin dilution.

Financial performance: revenue and profitability trends (high level):

From available financial summaries shared in investor materials and market notes, ACJKEL has shown:

Revenue growth over recent years, reaching around the ₹2,000 crore scale in the latest year referenced in investor summaries.

Improving EBITDA margins, reaching the 8% range in the same period.

Rising PAT, with profitability improving alongside scale though rice businesses remain sensitive to procurement prices, freight, currency, and export demand.

How to interpret these numbers

For a basmati processor / exporter, profitability is shaped by:

paddy procurement cost cycles,

inventory / ageing duration,

realization in export markets,

FX movement,

and working capital funding cost.

So investors typically track not only EBITDA / PAT, but also:

working capital days,

inventory quality and ageing strategy,

debt and finance cost, and

cash conversion cycle.

IPO objective: why working capital is central in this business.

The draft documents indicate the issue proceeds are primarily intended for working capital requirements.

That is consistent with how basmati businesses operate:

large seasonal procurement,

long inventory holding / ageing cycles,

receivables ,especially exports,

and continuous packaging/distribution needs.

For investors, this becomes a key diligence item:

Does working capital funding translate into higher volumes and better realizations, or does it simply support the same cycle at a bigger balance-sheet cost?

Outlook: what could drive the next leg of growth?

Based on stated strategy themes and typical category dynamics, the next phase for ACJKEL is likely to hinge on four levers:

1) Stronger domestic penetration

Especially expansion into Tier 3 and Tier 4 markets through deeper distribution and targeted brand activity.

2) Brand investments with measurable ROI

If the company increases advertising (celebrity / digital, etc.), investors will watch: whether sales growth accelerates, and whether gross margin and EBITDA hold up.

3) FMCG staples expansion

If staples gain share, it can:

improve distributor economics,

create bundling opportunities,

and reduce single-category dependence.

4) Better capacity utilization

Improved utilization can lift operating leverage provided procurement discipline and realization remain healthy.

Key risks investors should track.

No IPO analysis is complete without the risks that matter in basmati / FMCG staples:

Raw material (paddy) price volatility and inventory holding risk

Working capital intensity and sensitivity to interest rates

Export dependence and geopolitical / logistics disruptions

FX exposure (depending on hedging policy and customer mix)

Competition from larger branded peers with higher ad budgets

Regulatory and quality compliance expectations in export markets

Bottom line

ACJKEL (Aeroplane brand) is entering the market as a scaled basmati processor-exporter with:

long operating history and legacy roots,

integrated value-chain operations,

meaningful export footprint,

and a strategy to expand domestic penetration and FMCG staples.

With the ₹550 crore IPO receiving SEBI approval, investor attention will likely concentrate on:

working capital efficiency,

margins through commodity cycles,

brand investment discipline,

and how quickly the company converts capacity headroom into profitable volume growth.

Quick FAQ on IPO:

Q1. Is the ACJKEL IPO fresh issue or OFS?

As per draft disclosures, it is positioned as a 100% fresh issue (no OFS indicated in draft structure).

Q2. What is the IPO size?

₹550 crore.

Q3. Has the price band been announced?

Often it is not finalized in the DRHP and is announced closer to the issue via RHP and public advertisements. Market indications are ₹200–₹210,

Q4. What does the company do?

Primarily basmati rice processing and exports under the Aeroplane brand, with a growing FMCG staples portfolio.

Team: CreditMoneyFinance.com

More Featured Articles:

Kotak Mahindra Bank – SME & Wholesale Lending Solutions (₹7–200 Cr)

SIDBI – Powering India’s MSME Growth: Funding, Schemes & Business Support

IN-SPACe and SIDBI Launch ₹1,000 Crore Space Venture Capital Fund to Boost India’s Space Startups

SME IPO in India 2025: Complete Guide for Investors & Growing Businesses

Building Future Leaders: The Birla Open Minds School Franchise Opportunity

Why MSMEs Trust Us With Their Most Critical Financial Decisions