Unicorns Are Losing Their Luster: Why Investors Are Starting to Prefer Tortoise-Style Startups Over High-Burn Unicorns.

Startups chasing unicorn valuations are losing investor appeal. Learn why steady, sustainable tortoise-style companies are becoming the new favorite in venture funding.

🐢 Unicorns Are Losing Their Luster:

Why Investors Could Start Preferring Tortoises Instead

For over a decade, the global startup ecosystem has worshipped unicorns companies that reached the coveted billion-dollar valuation in record time. Hyper-growth, blitz-scaling, and aggressive capital burn became the gold standard. Founders proudly claimed they were building “the next Uber,” “the next Zomato,” or “the next Amazon,” and investors poured money into anything that promised hockey-stick-shaped growth.

But the winds are shifting.

Economic uncertainty, liquidity tightening, and repeated cases of overvalued startups collapsing have forced investors to rethink their approach. Today, there is a visible pivot toward tortoise-style businesses , slow, steady, fundamentals-first companies with sustainable growth.

If you’re raising capital or building a startup today, this shift matters deeply..

You may not need to chase the unicorn dream. Instead, your strength may lie in being the tortoise everyone overlooked…until now.

Also Read: Angel Investing in Bharat: The New Wave of Micro-Angels

🐢 Why Tortoise Startups Are Becoming More Attractive.

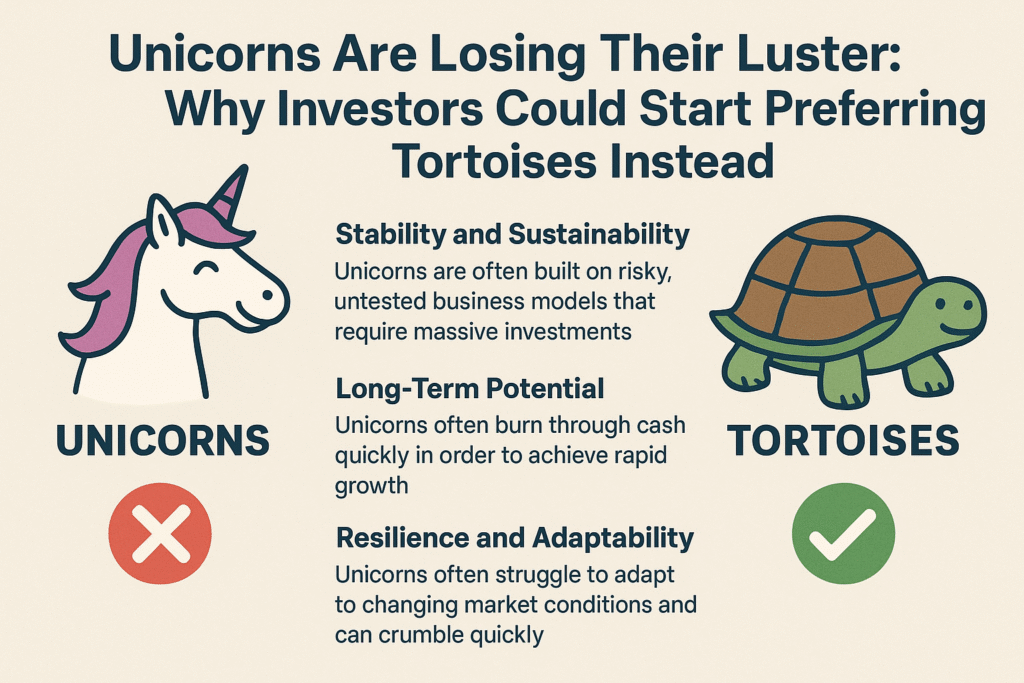

1. Stability and Sustainability above Flashy Valuations.

🦄 Unicorn Model:

Most unicorns achieve valuation milestones before profitability. They often rely heavily on external capital injections, subsidized growth, and aggressive customer acquisition. The moment funding dries up, cracks appear.

🐢 Tortoise Approach:

Tortoises are built on strong fundamentals unit economics, cash flow, realistic growth metrics and profitability goals. They don’t aim to dominate overnight; instead, they build layer by layer, ensuring structural stability.

Investors increasingly prefer sustainable business models over vanity valuations.

2. Long-Term Potential Instead of Short-Term Hyper-Growth.

🦄 Hyper-growth unicorns burn cash rapidly to scale fast. This velocity can create pressure to expand unrealistically, sometimes compromising product quality, culture, or operational health.

🐢 Tortoise companies grow slowly. They reinvest earnings, mature their offerings, and create revenue streams that last. Their goal is business longevity , not just valuation milestones.

In an uncertain economy, longevity is becoming sexier than speed.

3. Resilience and Adaptability in Tough Markets.

Startups today face inflation, funding winter, customer churn, rising CAC, and unpredictable market conditions. Unicorns, optimized for explosive growth, often find it difficult to pivot when the model becomes unsustainable.

🐢 Tortoises are lean, grounded, and resilient. They evolve as markets shift. Slow growth means they constantly learn, iterate, and strengthen their base.

A tortoise knows how to survive when storms hit and storms are hitting more often.

Also Read: Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

📉 Why Unicorn Fever Is Cooling Off.

Recent years have exposed serious vulnerabilities in unicorn-style scaling:

High valuation doesn’t always equal profitability

Many unicorns struggle post-IPO due to weak fundamentals

Down-rounds and layoffs have increased globally

Investors are more cautious with capital deployment

Due diligence is now deeper and more data-driven

The narrative is changing from “How fast can you scale?” to “How long can you survive and profitably scale?”

This is a massive psychological shift in the startup world.

🐢 The Rise of the Tortoise Mindset in Entrepreneurship

In this new era, founders embracing the tortoise philosophy stand out:

✔ Focus on profitability over valuation

✔ Build real customer value instead of hype

✔ Grow step-by-step, market-wise and financially wise

✔ Prefer unit economics that make sense from day one

✔ Take fewer but more strategic risks

This isn’t about being slow , it’s about being smart, durable, and patient.

Sustainable > explosive.

Profitable rather than popular.

Enduring more than glamorous.

The race is long and slow runners might finally win.

💡 Conclusion: Are You a Unicorn or a Tortoise?

Unicorn culture isn’t dead but it’s no longer the only path. The startup future may be shaped by steady, revenue-oriented builders instead of valuation-hungry sprinters.

In an unpredictable economy, founders who focus on sustainable growth, customer value, and operational efficiency may become the real winners.

As the story goes…

🦄 Unicorns sprint fast.

🐢 Tortoises finish the race.

✍ Final Thought

That’s why many seasoned entrepreneurs and investors today are embracing the tortoise approach to building companies , slow, thoughtful, strong, and lasting.

So ask yourself:

Are you building a 🦄 unicorn or a 🐢 tortoise? And which one will still be standing in 10 years?

Team: Creditmoneyfinance.com

More Featured Articles :

Speciale Invest Launches ₹1,400 Crore Growth Fund II to Accelerate India’s Deeptech Scale-Up Story

SIDBI – Powering India’s MSME Growth: Funding, Schemes & Business Support

Startup Funding Advisory Services in India for High-Growth Startups Ready to Raise Capital.