The Quiet Millionaire Who Showed the World What Patience Can Do.

Discover the inspiring story of Ronald Read, the quiet janitor who built an $8M fortune through patience, frugality, and long-term investing. A powerful lesson in compounding and financial discipline.

How did a humble janitor become a millionaire? Learn Ronald Read’s powerful wealth-building strategy based on simplicity, patience, and consistent investing.

Ronald Read shows how anyone can build wealth by living below their means, investing steadily, and letting compounding work over time. A remarkable personal finance lesson for long-term investors.

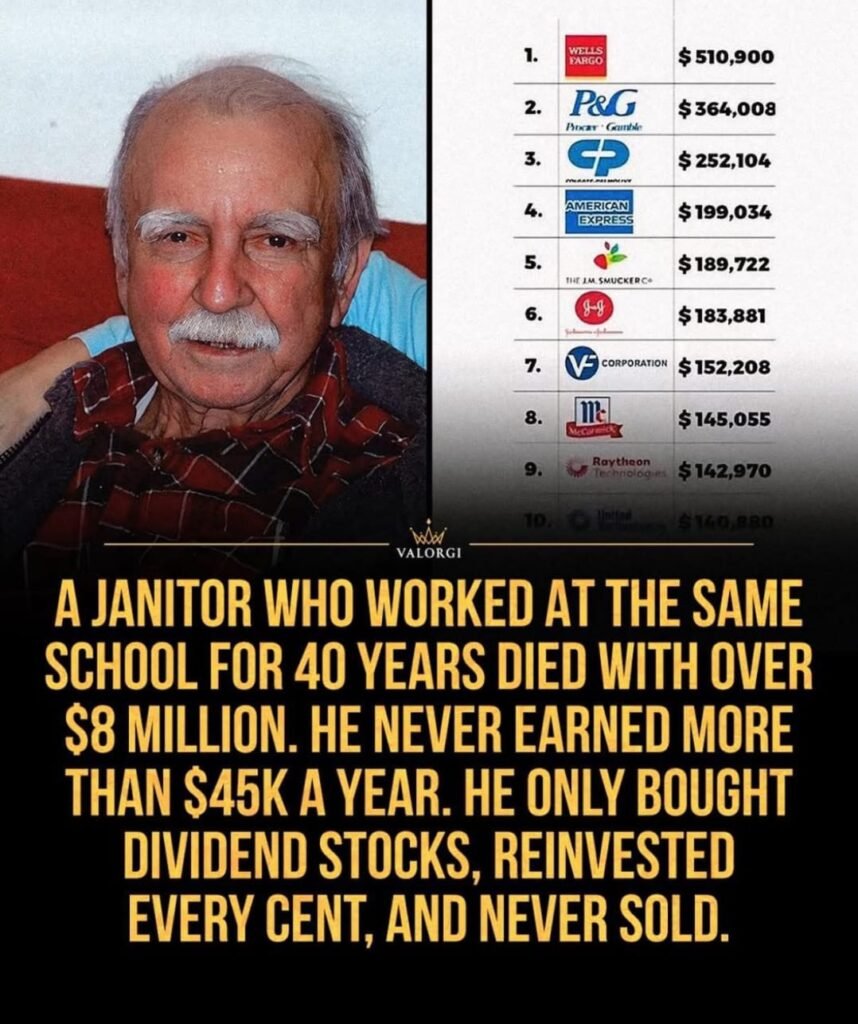

The life of Ronald Read feels almost unbelievable. Born in 1921, he lived as simply as a person could. He worked as a janitor and at a gas station, nothing flashy, nothing that signaled wealth. To everyone around him, he appeared to be an ordinary man living an ordinary life. But beneath that simplicity was a quiet, powerful secret. Over several decades, Ronald Read slowly built an $8 million fortune.

Please Read: Angel Investing in Bharat: The New Wave of Micro-Angels

How Did He Do It?

– He lived far below his means

– He saved regularly

– He invested in strong, dividend paying companies

– And most importantly, he held those investments for decades

His portfolio featured giants like Johnson & Johnson, Procter & Gamble, JPMorgan, and Dow Chemical, steady, durable businesses that kept growing and paying dividends year after year. He almost never sold. He let compounding work uninterrupted.

When Read passed away in 2014 at age 92, the town was shocked. He donated $6 million to the local hospital and $2 million to the public library. Nobody had the slightest idea he was wealthy.

The Power of Patience and Consistency

His story shows that long term investing isn’t magic, it’s math, patience, and consistency. You don’t need a high income to build wealth. You need time, discipline, and the courage to be boring.

Personal Finance Lesson

Wealth is rarely built through extraordinary actions. It is built through ordinary actions repeated for an extraordinarily long time.

Your savings rate matters more than your salary.

Your discipline matters more than your timing.

And compounding only rewards the investor who learns to sit still.

In personal finance, the most powerful strategy is simple: Spend less than you earn, invest more than you think, and stay invested longer than feels comfortable.

Team : Credit Money Finance

Other Interesting Articles:

Why Every Startup and Growing Business Needs a Virtual CFO And Why IntellexCFO Is Your Best Partner