Startup India Registration: Unlocking Tax Benefits and Growth

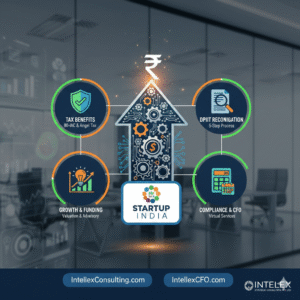

Unlock massive growth with Startup India Registration. Learn how to claim a 3-year tax holiday (80-IAC) and Angel Tax relief. Get expert guidance from Intellex Strategic Consulting Pvt Ltd on DPIIT recognition and financial scaling

In the dynamic business landscape of 2026, the Startup India Initiative remains the most powerful catalyst for entrepreneurs looking to scale. Beyond the prestige of being a “Government Recognized Startup,” the real value lies in the substantial 80-IAC tax exemptions, Angel Tax relief, and intellectual property rebates that can save a growing company millions in its first decade.

However, navigating the DPIIT recognition process and ensuring compliance for long-term benefits requires professional precision. This is where Intellex Strategic Consulting Pvt Ltd steps in as your premier financial advisory partner.

- Also Read: Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

The Strategic Importance of Startup India Registration

The Department for Promotion of Industry and Internal Trade (DPIIT) has streamlined the registration process to focus on innovation, development, and scalability. Registration is not just a certificate; it is a gateway to:

- Three-Year Tax Holiday: 100% tax deduction on profits under Section 80-IAC.

- Angel Tax Freedom: Exemption from tax on share premium under Section 56(2)(viib).

- IPR Support: Up to 80% rebate on patent filings and 50% on trademarks.

- Government Procurement: Relaxation of “prior experience” and “turnover” criteria for public tenders.

Eligibility Criteria for Startup India Recognition (2026 Update)

To qualify for DPIIT recognition, your entity must meet the following updated requirements:

- Entity Type: Must be a Private Limited Company, a Limited Liability Partnership (LLP), or a Registered Partnership Firm. (Sole proprietorships remain ineligible).

- Age of Entity: Not older than 10 years from the date of incorporation.

- Turnover Limit: Annual turnover must not have exceeded ₹100 Crore in any financial year since incorporation.

- Originality: The entity should not be formed by splitting up or reconstructing an existing business.

- Innovation Focus: Must be working toward the innovation, development, or improvement of products, processes, or services, or have a scalable business model with high potential for employment/wealth creation.

Also Read: Ultimate Guide to Singapore Company Registration 2026: Rules, Costs, and Compliance

Unlocking the 3-Year Tax Exemption (Section 80-IAC)

While DPIIT recognition is the first step, the Section 80-IAC tax exemption is a separate, more rigorous application.

How It Works:

Eligible startups can avail of a 100% tax deduction on profits for three consecutive financial years out of their first ten years. This is a game-changer for startups reaching their “break-even” point and entering a high-profit phase.

Key Requirements for 80-IAC:

- Must be a Private Limited Company or an LLP.

- Must be incorporated between April 1, 2016, and March 31, 2030 (Extended in recent budgets).

- The Inter-Ministerial Board (IMB) reviews the “innovative nature” of the business before granting approval.

Angel Tax Relief: Section 56(2)(viib)

For years, “Angel Tax” was a hurdle for founders raising capital at a premium. Under current regulations, recognized startups are exempt from tax on the capital raised above Fair Market Value (FMV), provided:

- The aggregate amount of paid-up share capital and share premium does not exceed ₹25 Crore after the issue.

- The startup does not invest in specific assets like residential property (not for business), jewelry, or shares/securities for a specified period.

The 5-Step DPIIT Recognition Process

- Business Incorporation: Establish your P Ltd or LLP and obtain a PAN.

- Startup India Portal Registration: Create a profile on startupindia.gov.in.

- Application for Recognition: Fill in details regarding your “Innovation” and “Scalability.”

- Document Upload: Submit your Certificate of Incorporation and a brief write-up/pitch deck on your business model.

- Recognition Certificate: After verification (usually within 48–72 hours for clean applications), the DPIIT certificate is issued.

Also Read: SME IPO in India: A Comprehensive Guide for Growing Businesses Looking to Go Public:

Why Choose Intellex Strategic Consulting Pvt Ltd?

Registering a startup is easy; maintaining eligibility and maximizing tax savings is the hard part. Intellex Strategic Consulting Pvt Ltd is a leading Financial Advisory Firm that provides end-to-end support for the startup ecosystem.

Our Specialized Services:

- Startup India & 80-IAC Filings: Expert drafting of innovation statements to ensure IMB approval.

- Virtual CFO Services: Professional financial management via IntellexCFO.com.

- Fundraising Advisory: Pitch deck preparation and investor connect.

- Compliance Management: Ensuring your startup stays compliant with MCA, Income Tax, and GST laws.

- Business Valuation: Certified valuations for Angel Tax and VC rounds.

Expert Guidance at Your Fingertips

The difference between a “registered startup” and a “tax-exempt growing venture” lies in the quality of advisory. Don’t let technicalities or weak applications hold your growth back.

Contact Intellex Today:

- Websites: IntellexConsulting.com | IntellexCFO.com

- WhatsApp: 98200-88394

- Email: intellex@intellexconsulting.com

Team: IntellexConsulting.com

More Featured Articles:

Angel Investing in Bharat: The New Wave of Micro-Angels

IIT Bombay Launches First-of-Its-Kind ₹250 Crore Deep-Tech VC Fund to Empower Early-Stage Startups

Ultimate Guide to Singapore Company Registration 2026: Rules, Costs, and Compliance

Ultimate Guide to Early Stage Startup Funding in MENA (2026): Top Investors & Strategies

Angrezi Dhaba: India’s Fusion Dining Brand Expands Globally — Franchise Opportunities Open!

The Rise of ClimateTech and AgriTech Startups in India: Innovation for a Sustainable Future

Kak esehiko sminor k112 startupstreets.com

55 thousand Greek, 30 thousand Armenian

**neurosharp**

Neuro Sharp is an advanced cognitive support formula designed to help you stay mentally sharp, focused, and confident throughout your day.

**boostaro**

Boostaro is a purpose-built wellness formula created for men who want to strengthen vitality, confidence, and everyday performance.

**mounja boost**

MounjaBoost is a next-generation, plant-based supplement created to support metabolic activity, encourage natural fat utilization, and elevate daily energywithout extreme dieting or exhausting workout routines.

**prodentim**

ProDentim is a distinctive oral-care formula that pairs targeted probiotics with plant-based ingredients to encourage strong teeth, comfortable gums, and reliably fresh breath

Pallet rack safety standards are critical for preventing accidents in warehouses. Racks should always be properly anchored to prevent tipping.

Clearly display load limits to inform employees about safe weight distribution. Overloading or uneven loads can compromise the structure and lead to accidents.

Examine your racks periodically for any signs of damage. Replace or repair damaged components as soon as possible.

Proper safety practices ensures longevity, productivity, and peace of mind.

https://rgpalletracking.com/ – Pallet Rack Merchants

http://habersizseniz.com/paten-nasil-temizlenir/ – Learning Warehouse Racking Safety Guidelines 1d68453

Europe, and in Ancient Russia

Многие жители в вашем районе постоянно жалуются на:

– медленную загрузку страниц;

– ограниченную скорость в часы пик;

– сложности с настройкой оборудования.

Доверие рекламным слоганам часто приводят к:

– потере времени;

– отсутствию техподдержки;

– невыполненным обещаниям.

Только надёжный провайдер обеспечивает:

– стабильный интернет 24/7;

– гибкие условия;

– бесплатную настройку оборудования.

«СибСети» в Новосибирске предлагают:

• высокоскоростной интернет до 500 Мбит/с;

• бесплатный монтаж оборудования;

• бонусы для новых абонентов.

• Точную оценку покрытия сети в вашем доме

• Определение оптимального пакета услуг под ваши задачи

• Проверку возможности подключения по вашему адресу

• Профессиональную установку оборудования

• Персональную помощь менеджера

• Прозрачные условия на весь срок обслуживания

Выяснить техническую возможность интернета и ТВ

Выяснить техническую возможность подключения в новостройке – http://internet-sibirskie-seti.ru

http://kanebrownpresale.com/__media__/js/netsoltrademark.php?d=https://internet-sibirskie-seti.ru/

Высокоскоростной интернет и цифровое ТВ от «СибСети» в вашем доме 07cd41d