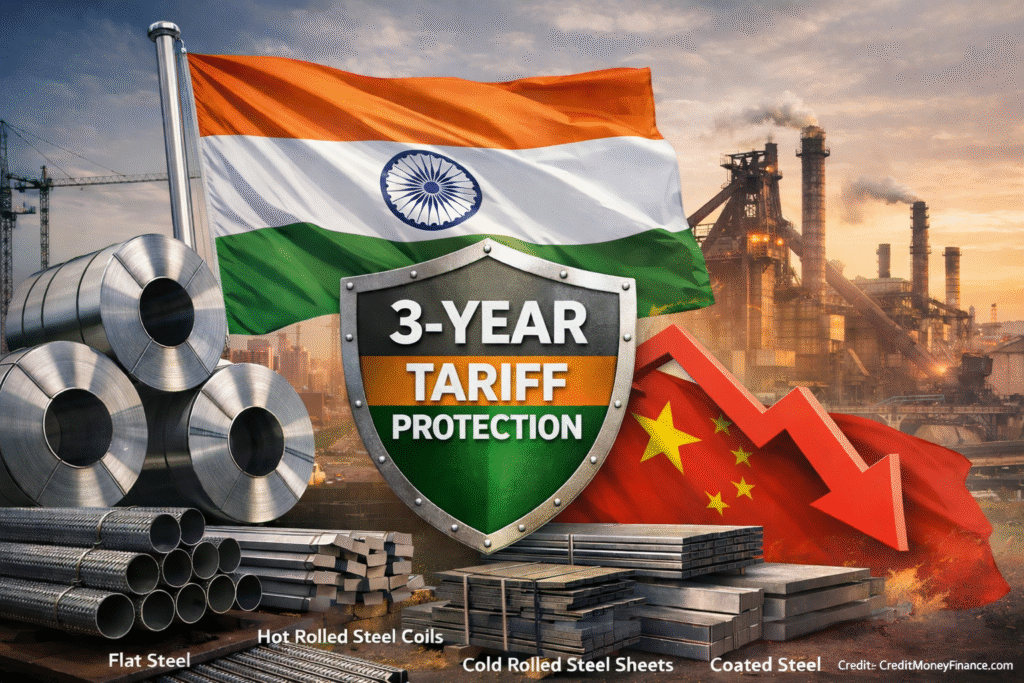

India Imposes 3-Year Safeguard Tariff on Steel Imports: A Strategic Push for Self-Reliance and Domestic Industry Protection:

India imposes a 3-year safeguard tariff on steel imports to curb cheap inflows, protect domestic steelmakers, boost margins, and strengthen self-reliance under Atmanirbhar Bharat.

India has taken a decisive policy step by imposing a 3-year safeguard tariff on select steel products, signaling a strong commitment to protecting domestic manufacturers from a surge in low-priced imports.

This move comes at a time when global steel markets are facing oversupply, particularly from China, and Indian steel producers have been under pressure due to aggressive import pricing.

The steel safeguard duty is designed to provide temporary relief to Indian steelmakers, allowing them to stabilize operations, improve capacity utilisation, and protect profitability, while reinforcing India’s broader self-reliance and industrial policy goals.

Also Read:

Why India Imposed a 3-Year Safeguard Tariff on Steel:

Over the past year, India witnessed a sharp increase in steel imports, especially from China and other East Asian economies. These imports were often priced significantly lower than domestic steel, putting pressure on Indian producers across flat and long steel categories.

The key drivers behind the safeguard tariff include:

Surge in cheap steel imports, particularly from China

Margin pressure on domestic steel manufacturers,

Risk of underutilisation of Indian steel capacity,

Need to maintain long-term competitiveness of the Indian steel industry,

By imposing a time-bound 3-year tariff, India aims to give local manufacturers breathing space without permanently shutting the door on global trade.

China to Be the Most Impacted:

China is expected to be the largest impacted exporter due to this decision. A significant portion of India’s steel imports over the last few quarters originated from China, often at aggressively discounted prices amid weak domestic demand in the Chinese market.

With the safeguard duty in place:

Chinese steel becomes less price-competitive in India

Import volumes are likely to decline sharply.

Indian buyers may shift towards domestically produced steel.

This move aligns with India’s growing focus on reducing dependency on Chinese industrial imports, especially in strategic and core sectors like steel.

Impact on Indian Steel Manufacturers:

The safeguard tariff is widely seen as a positive structural development for Indian steel producers.

Key benefits include:

Improved steel margins due to reduced import pressure,

Higher capacity utilisation at Indian steel plants,

Better pricing power for primary and secondary steel producers,

Increased confidence for future capex and expansion plans,

Large players as well as mid-sized manufacturers stand to benefit, especially those operating in flat steel, hot-rolled coils, and coated steel segments.

In the medium term, this could strengthen India’s position as a globally competitive steel producer rather than just a price-taker in international markets.

Short-Term Impact on Infrastructure and Auto Sectors:

While the policy strongly favors domestic steelmakers, it may result in mild cost inflation for downstream industries in the short term.

Potential challenges include:

Slightly higher steel input costs for infrastructure projects,

Marginal impact on automobile and capital goods manufacturers,

Temporary pressure on construction and real estate margins,

However, experts believe this impact will be limited and manageable, especially when weighed against the long-term benefits of a stable domestic steel ecosystem. Government-led infrastructure projects may also absorb part of the cost increase through scale efficiencies.

Also Read:

Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

Clear Policy Signal: Local Industry Comes First:

The safeguard tariff sends a clear and strong policy message:

India is willing to accept controlled price pressure in the short term to ensure the long-term health of its domestic manufacturing base.

This aligns closely with flagship initiatives such as:

Atmanirbhar Bharat,

Make in India,

Production-Linked Incentive (PLI) schemes,

Strengthening core and strategic industries,

Steel remains a backbone sector for infrastructure, defence, automobiles, railways, and urban development making its protection a strategic priority.

A Strategic Step Towards Self-Reliance in Steel:

India is already the second-largest steel producer in the world, but global volatility and unfair trade practices have often disrupted domestic markets. The 3-year safeguard tariff provides India with:

Time to enhance efficiency and cost competitiveness,

Opportunity to move up the value chain and

Greater resilience against global dumping cycles.

Rather than being protectionist, the move is best seen as strategic and corrective, ensuring fair competition while encouraging domestic capacity building.

Conclusion:

India’s decision to impose a 3-year safeguard tariff on steel imports marks a significant milestone in its industrial and trade policy. By prioritising domestic steel manufacturers, curbing cheap imports especially from China and reinforcing self-reliance, the government has laid the foundation for a more resilient and competitive steel sector.

While infrastructure and auto players may face slight short-term cost pressures, the long-term gains in stability, supply security, and industrial growth far outweigh the challenges.

This move underscores a powerful policy stance:

Protect core industries today to build a stronger, self-reliant India tomorrow.

Team: CreditMoneyFinance.com

More Featured Articles:

SIDBI – Powering India’s MSME Growth: Funding, Schemes & Business Support

Comprehensive Accounting, Taxation, GST & Business Advisory Services in India