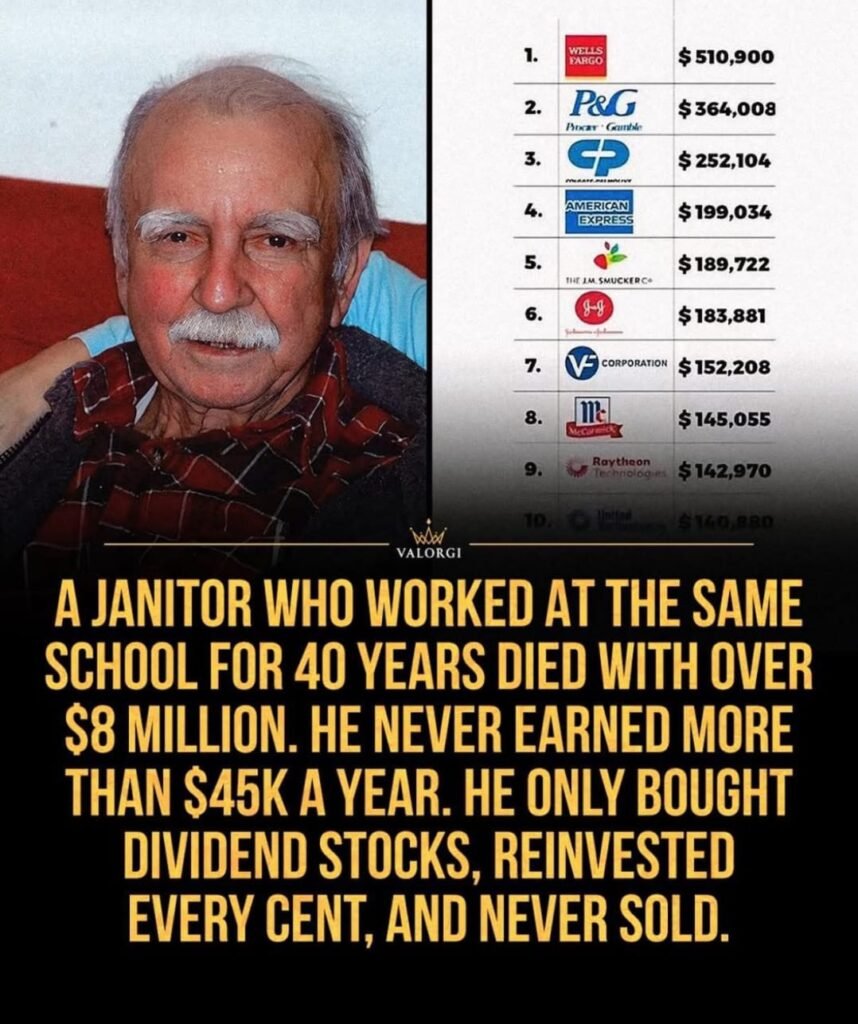

The Quiet Millionaire Who Showed the World What Patience Can Do

The Quiet Millionaire Who Showed the World What Patience Can Do. Discover the inspiring story of Ronald Read, the quiet janitor who built an $8M fortune through patience, frugality, and long-term investing. A powerful lesson in compounding and financial discipline. How did a humble janitor become a millionaire? Learn Ronald Read’s powerful wealth-building strategy based […]

The Quiet Millionaire Who Showed the World What Patience Can Do Read More »