New GST Framework for Pan Masala & Tobacco Effective from 1 February 2026:

What Businesses and States Need to Know: Overview of the Revised Tax Mechanism:

New GST framework for Pan Masala and Tobacco effective 1 February 2026 replaces compensation cess with health cess and excise duties while keeping overall tax incidence unchanged and increasing State revenues.

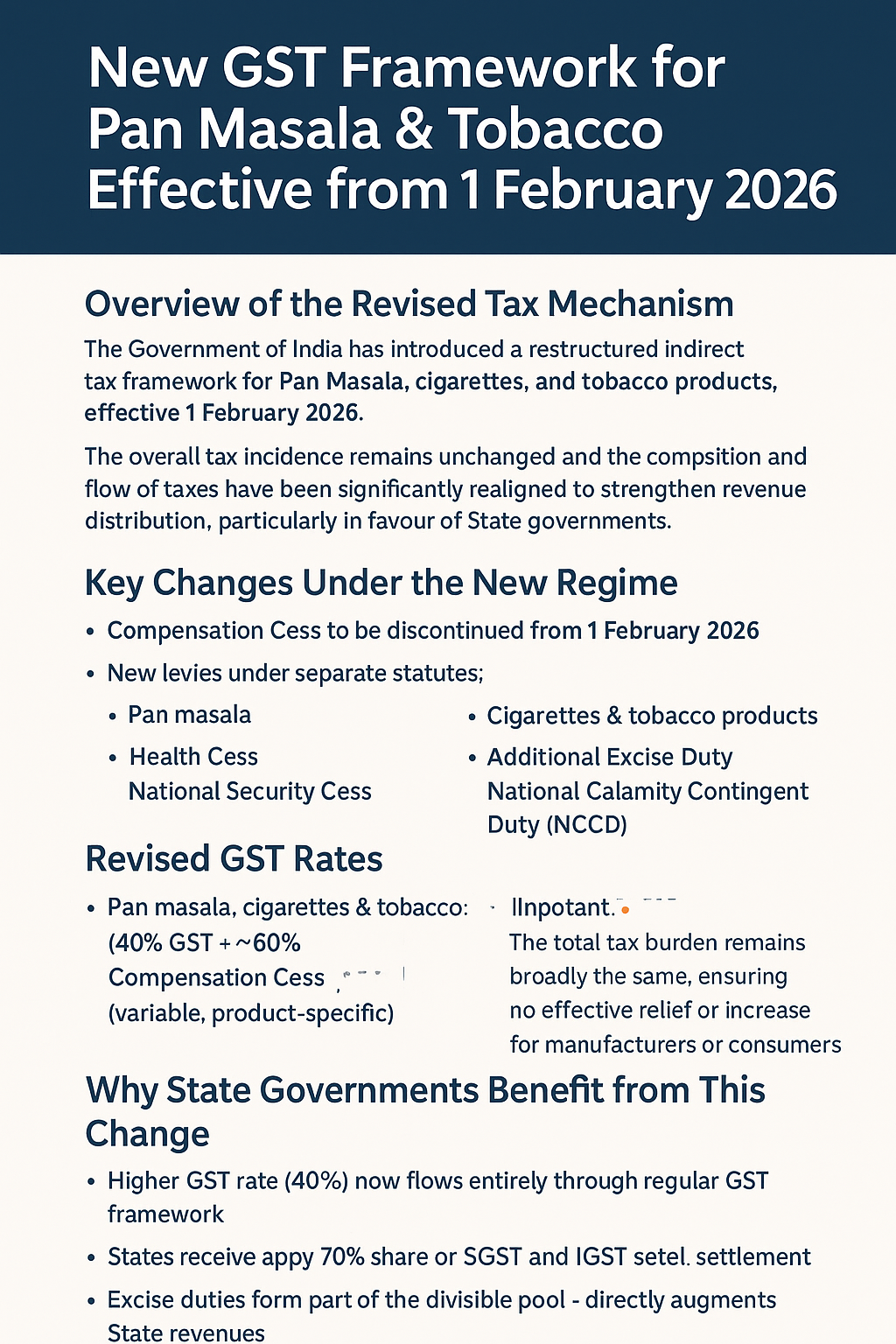

The Government of India has introduced a restructured indirect tax framework for Pan Masala, cigarettes, and tobacco products, effective 1 February 2026.

While the overall tax incidence remains unchanged, the composition and flow of taxes have been significantly realigned to strengthen revenue distribution, particularly in favour of State governments.

Key Changes Under the New Regime:

Compensation Cess to be discontinued from 1 February 2026.

Introduction of new levies under separate statutes:

For Pan Masala: Health Cess and National Security Cess

For Cigarettes & Tobacco Products : Additional Excise Duty and National Calamity Contingent Duty (NCCD)

Revised GST Rates

Pan Masala, Cigarettes & Tobacco: 40% GST

Earlier Structure: 28% GST

Compensation Cess (variable, product-specific)

👉 Important: The total tax burden remains broadly the same, ensuring no effective relief or increase for manufacturers or consumers.

Overall Tax Incidence Explained

1. Pan Masala

Total tax incidence: 88% (unchanged)

Earlier : 28% GST + 60% Compensation Cess

Revised Tax: 40% GST + 48% Health & National Security Cess

2. Cigarettes & Tobacco Products:

No reduction in tax burden.

Continues to be constitutionally liable to both GST and Central Excise.

Additional Excise Duty and NCCD replace the Compensation Cess without altering the effective incidence.

Also Read:

Why Every Startup and Growing Business Needs a Virtual CFO And Why IntellexCFO Is Your Best Partner

Why State Governments Benefit from This Change:

Higher GST rate (40%) now flows entirely through the regular GST framework

States receive approximately 70% share through SGST and IGST settlement.

Excise duties form part of the divisible pool, directly augmenting State revenues

Net outcome: States receive higher and more predictable revenue compared to the earlier compensation-based model.

Conclusion:

The revised GST mechanism for Pan Masala and Tobacco products represents a structural realignment rather than a tax hike or reduction. While businesses experience no material change in overall tax incidence, States stand to gain through enhanced revenue visibility and distribution efficiency. Companies operating in these sectors should realign compliance, pricing models, and accounting systems well ahead of the 1 February 2026 implementation date.

Team: CreditMoneyFinance.com

More Featured Articles:

Scale Without Selling Out: The Definitive Guide to Revenue-Based Financing in India

Kotak Mahindra Bank – SME & Wholesale Lending Solutions (₹7–200 Cr)

How Ex-Bankers Can Build a High-Income Second Career Through a Corporate DSA Partner Program