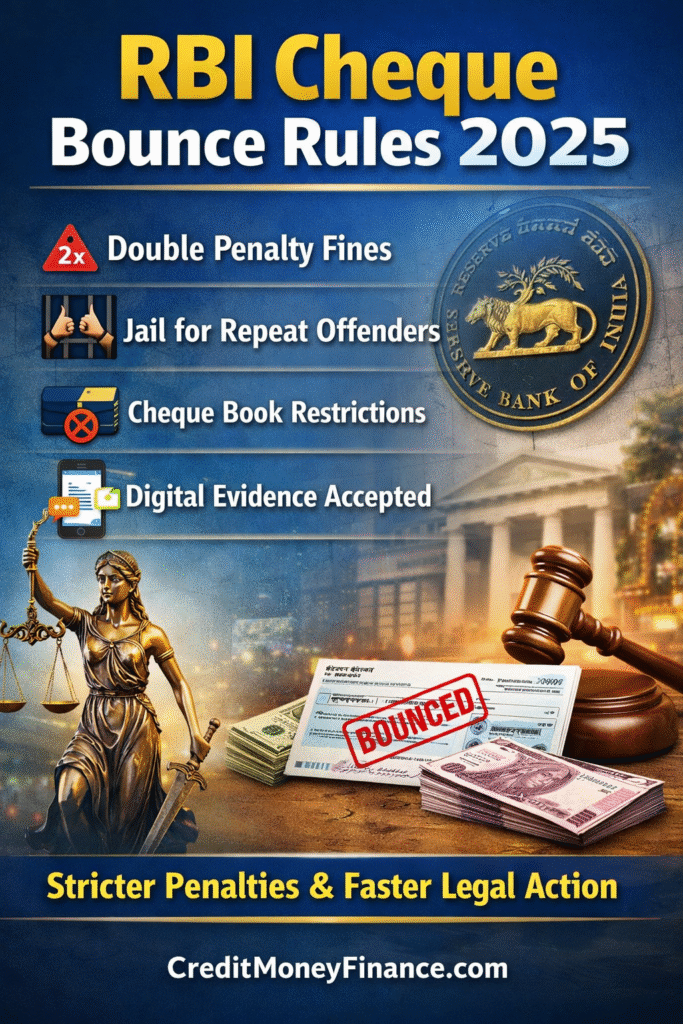

RBI Cheque Bounce Rules 2025: New Penalties, Jail Provisions & Faster Legal Process Explained.

RBI Cheque Bounce Rules 2025 explained: double penalties, jail for repeat offenders, fast-track courts, no court fees, and digital evidence under Section 138 NI Act.

Introduction:

The Reserve Bank of India (RBI), in alignment with judicial and banking reforms, has significantly strengthened the cheque bounce framework in 2025. These changes aim to curb cheque misuse, enhance financial discipline, and restore confidence in cheque-based transactions across India.

Under the revised framework linked to Section 138 of the Negotiable Instruments Act, 1881, penalties are stricter, enforcement is faster, and digital evidence is now fully recognised. This article explains the key highlights, legal impact, and practical implications of the new RBI cheque bounce rules for individuals, businesses, and financial institutions.

Also Read:

Key Highlights of RBI Cheque Bounce Rules 2025:

1. Double Penalty for Bounced Cheques

One of the most impactful changes is the increase in financial penalties.

Courts can now impose fines up to twice the cheque amount.

The objective is to discourage casual or deliberate issuance of cheques without sufficient funds.

This change sends a strong signal to habitual defaulters and improves payment accountability.

2. Jail Term for Repeat and Serious Offenders

The 2025 reforms place a strong emphasis on intent and repetition.

Repeat offenders and cases involving high-value or intentional defaults may face imprisonment.

Courts will consider the nature of the transaction and conduct of the drawer before awarding punishment.

This provision reinforces cheque bounce as a serious criminal offence, not merely a civil dispute.

3. Banks Empowered to Restrict Cheque Book Facilities

Banks now have greater authority to manage cheque-related risks.

Customers with multiple cheque bounce incidents may face suspension or restriction of cheque book issuance.

This move strengthens internal banking controls and reduces systemic misuse.

4. No Court Fee & Faster Case Disposal

To reduce litigation burden and delays:

No court fees are required for filing cheque bounce complaints under Section 138.

Fast-track mechanisms are introduced for quicker hearings and resolutions.

This ensures justice is more accessible and time-efficient for complainants.

5. Continued Applicability of Section 138, NI Act, 1881

Cheque bounce remains a criminal offence if:

Payment is not made within the statutory notice period after dishonour.

Legal timelines under the Negotiable Instruments Act are not complied with.

The 2025 changes reinforce the seriousness of Section 138 rather than dilute it.

6. Digital Evidence Now Legally Valid

Recognising modern banking practices, courts can now rely on:

SMS alerts,

Email communications,

Bank app notifications,

Digital transaction messages,

This reduces dependency on physical documents and speeds up legal proceedings.

Impact on Businesses and Individuals:

The revised rules significantly improve:

Payment discipline,

Credibility of cheques as negotiable instruments,

Ease of legal enforcement,

Trust in commercial transactions,

Businesses, lenders, MSMEs, and professionals using cheques must now exercise greater caution and compliance.

Conclusion

The RBI Cheque Bounce Rules 2025 represent a decisive step toward strengthening India’s financial ecosystem. By introducing higher penalties, jail provisions, digital evidence acceptance, and faster judicial processes, the reforms aim to deter defaults and promote responsible financial behaviour.

Cheque issuance is no longer a casual commitment, it is a legally enforceable promise with serious consequences.

Team: CreditMoneyFinance.com

More Featured Articles:

Infrastructure Finance in India: Concept, Evolution, Key Players, and the Road Ahead.

SIDBI – Powering India’s MSME Growth: Funding, Schemes & Business Support

Kotak Mahindra Bank – SME & Wholesale Lending Solutions (₹7–200 Cr)