China’s Trade Surplus Hits $1 Trillion: What’s Driving the Record Imbalance.

China’s trade surplus reached a historic $1 trillion in 2025 as exports surged and imports weakened. High-tech goods, EVs, semiconductors, a weak yuan, and rare-earth dominance explain the imbalance.

A Historic Milestone for China’s Trade Balance.

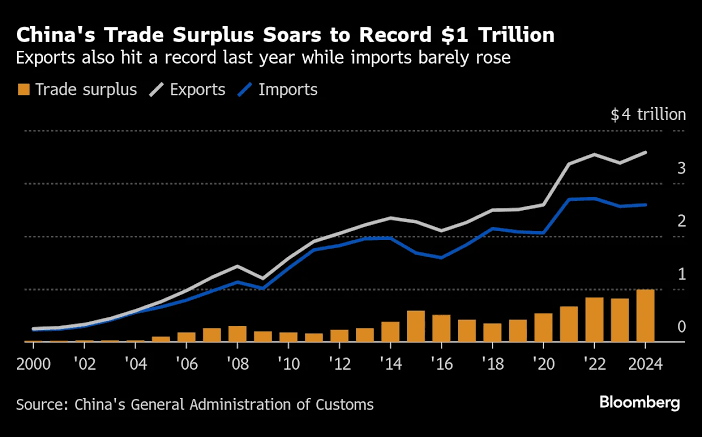

China has recorded its largest-ever trade surplus, crossing the $1 trillion mark for the first time. Data from the General Administration of Customs shows that during the first 11 months of 2025, exports surged while imports softened, widening the trade gap at a pace that has drawn global attention.

For finance professionals, the number itself matters less than the structural forces behind it. The surplus reflects China’s evolving export mix, currency dynamics, and growing control over key industrial inputs..

Exports Outpace Imports by a Wide Margin.

Between January and November, China’s exports reached $3.4 trillion, while imports declined slightly to $2.3 trillion, resulting in a surplus of roughly $1 trillion.

Exports returned to growth in November after a brief October slowdown, rising 5.9 percent year-on-year, well ahead of the 1.9 percent increase in imports. The data suggests resilient external demand even as domestic consumption and investment remain comparatively subdued.

Trade Surplus Expands Sharply in 2025.

China’s goods surplus during the first 11 months of 2025 was 21.7 percent higher than a year earlier, indicating that export growth is not merely cyclical but increasingly structural.

This expansion comes at a time when global trade volumes are growing modestly, underscoring China’s ability to gain market share across multiple sectors despite trade frictions and geopolitical constraints.

High-Tech Manufacturing Leads Export Growth.

A notable feature of the current surplus is the outsized contribution from high-tech exports. Shipments of technology-intensive products grew 5.4 percentage points faster than overall exports, reinforcing China’s shift toward higher-value manufacturing.

Products linked to clean energy, advanced electronics, industrial automation, and precision equipment now account for a growing share of China’s export earnings supporting margins and competitiveness.

Electric Vehicles Reshape Global Auto Trade.

China’s auto exports surged in 2025, driven largely by electric vehicles. Chinese manufacturers expanded aggressively into overseas markets, eroding market share held by Japanese and German automakers.

According to Automobility, China’s total car exports increased by over one million units, reaching about 6.5 million vehicles this year. Competitive pricing, vertically integrated supply chains, and battery expertise have positioned Chinese EV makers as formidable global players.

Semiconductor Output Strengthens Supply-Chain Influence.

While China remains behind US firms such as Nvidia in cutting-edge chip design, it is becoming increasingly influential in semiconductor manufacturing, particularly for mature-node chips used in electric vehicles, medical devices, and industrial machinery.

Semiconductor exports rose 24.7 percent during the first 11 months of the year, strengthening China’s role in global technology supply chains and supporting export growth even amid ongoing technology restrictions.

Currency Dynamics Favor Exporters.

The renminbi’s relative weakness has also played a role in boosting China’s trade surplus. A cheaper currency lowers export prices in foreign markets while raising the cost of imports at home.

For exporters operating on thin margins, exchange-rate dynamics have provided an important competitive buffer, particularly against manufacturers in higher-cost economies.

Please Read: Family Office Investments in India: Fueling Startups, Scaleups & Growth-Stage Enterprises

Rare Earth Control Provides Strategic Leverage.

China’s dominance in rare earth metals remains a critical, often underestimated, pillar of its trade strength. The country is home to 12 of the 17 rare earth elements and accounts for 60 to 70 percent of global mining output.

More importantly, China controls roughly 90 percent of global rare-earth processing capacity, giving it a central role in industries ranging from electric vehicles and wind turbines to semiconductors and defense technology.

Implications for Global Trade and Policy.

China’s $1 trillion trade surplus highlights deepening global trade imbalances and raises policy questions for major economies.

Persistent surpluses may intensify calls for trade barriers, industrial subsidies, and supply-chain diversification.

For investors and policymakers, the key takeaway is that China’s surplus is increasingly driven by technology, scale, and strategic resources, not just low-cost labor. That makes it more durable and more consequential for the global economy.

Team: CreditMoneyFinance.com

More Featured Articles:

SIDBI – Powering India’s MSME Growth: Funding, Schemes & Business Support

Pre-IPO Investment: Meaning, Benefits, Risks & How to Find Pre-IPO Opportunities.

Tata Group: The Definitive Story of India’s Most Trusted Conglomerate

Building Future Leaders: The Birla Open Minds School Franchise Opportunity

TReDS: A Game-Changer for MSME Financing and Faster Payments in India